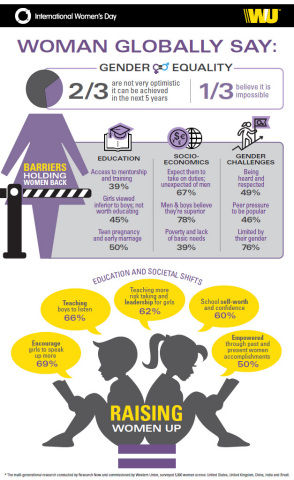

Business Wire IndiaA new global survey has found that women of all generations shared similar views about the serious challenges preventing their societies from achieving gender equality. In fact, more than two-thirds of women around the world are not very optimistic that gender equality can be achieved in the next five years, and more than 30 percent believe gender equality is impossible.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170307005573/en/

![WU Multi-generational Research Study - Executive Summary 2017 (Graphic: Business Wire)]()

WU Multi-generational Research Study - Executive Summary 2017 (Graphic: Business Wire)

Women across all five countries (United States, United Kingdom, China, India and Brazil) were unified in their view that unlocking education for girls is key to achieving gender equality, along with accomplishing societal shifts in how girls and women are viewed. Nearly two thirds (63 percent) see gaining equality and inclusivity in the workplace as a vital first step.

The multi-generational research conducted by Research Now and commissioned by Western Union (NYSE: WU), a global leader in payments and official International Women’s Day (IWD) sponsor, surveyed 5,000 women - spanning millennials, Gen X, boomers and senior groups - across the five countries.

Some of the key findings in the research include:

- 69% of women say girls need to be encouraged to speak up more to advocate for themselves, while 66% believe boys must be taught to listen, understand and respect more;

- More than 67% say society expects women to take on responsibilities that it does not expect men to take on;

- 78% feel that men and boys still believe they are superior to women;

- 45% identify social and cultural factors where girls are viewed as inferior to boys and not worth educating as a barrier to girls accessing a quality education;

- 62% say it is important to have educational programs that “teach girls diverse skills to be effective leaders and take risks”;

- 60% also feel that it is important to have school social programs that grow girls’ confidence/self-worth;

- Half of women want more lessons and textbooks to teach about the lives and accomplishments of women.

Education has the power to be life changing for girls and a key determinant of their quality of life. Eighty-four percent of women agree that if we break down the barriers to quality education for all girls, we can unlock their potential and develop women that will change the world - immaterial of where they are based across the globe.

President and CEO Western Union Hikmet Ersek,said: “These results are sobering, and show that all of us – as business leaders, global citizens, and parents – have a long way to go to achieve gender equality.

“Western Union believes that every girl, everywhere, should have the chance to pursue her dreams and goals. That’s why we are a proud participant in International Women’s Day and we’re proud that 90 percent of the grants provided through the Western Union Foundation over the past 15 years have gone towards education programs.”

In parallel, the Western Union Foundation is also announcing for IWD the “WU Scholars Program,”* a global scholarship program, dedicated to the education and empowerment of students around the world, including even more women.

“Education is one of the most important investments we can make,” Ersek added. “It turns girls into leaders. It turns global citizens into economic drivers, who then continue to invest in education. It breaks down barriers to education and empowers a bolder generation of young women to achieve their true potential.”

Western Union operates in more than 200 countries and territories around the world, and more than half of the people who sent money through its money transfer business in 2016 were women. Of those who received funds through Western Union, more than 65 percent were women.

The company has also undertaken a multi-year effort – the Chain of Betters initiative – to stimulate recognizing good deeds, and extraordinary efforts by people to help one another. This year, Western Union has created a short video that inspires communities to champion a bolder generation of women through education. The video www.wu.com/chainofbetters/iwd/ shines a light on young girls in tribute of International Women’s Day.

Breaking down barriers

These findings have inspired Western Union to expand its commitment to break down barriers across the globe and launch a $250,000 Global Scholarship Program, which launches on March 8 in line with IWD 2017. The program will provide financial support to students around the world, including young women, giving access to the knowledge and skills needed to pursue their dreams with confidence - www.WUScholars.org.

#BeBoldForChange

In honor of IWD, Western Union is inviting people to empower women by sharing the best, bold advice they’ve ever given or received about fearlessly pursuing a dream. It might be a piece of sage advice from your mom, your favorite inspirational quote, or something you say to your kids. Use hashtags #TheRaceIsOn#BeBoldForChange to inspire others and show you believe every girl deserves her place on the starting line.

To review the key global findings of the study, please visit https://www.westernunion.com/blog/women-globally-arent-optimistic-gender-equality/.

Key Country findings

United States:

- 80% of American women are not very optimistic that gender equality can be achieved in the next five years, and 20% believe gender equality is impossible;

- 74% say girls need to be encouraged to speak up more to advocate for themselves, while 69% believe boys must be taught to listen, understand and respect more;

- 69% say society expects women to take on responsibilities that it does not expect men to take on;

- 73% feel that men and boys still believe they are superior to women;

- 38% identify social and cultural factors, where girls are viewed as inferior to boys and not worth educating, as a barrier to girls accessing a quality education;

- 66% say it is important to have educational programs that teach girls diverse skills to be effective leaders and take risks;

- 52% want more lessons and textbooks to teach about the lives and accomplishments of women;

- 82% agree that if barriers to quality education for all girls are broken down, we can unlock their potential and develop women that will change the world;

- 71% see gaining equality and inclusivity in the workplace as a vital first step.

United Kingdom:

- 88% of British women are not very optimistic that gender equality can be achieved in the next five years, and 25% believe gender equality is impossible;

- 68% say girls need to be encouraged to speak up more to advocate for themselves, while 65% believe boys must be taught to listen, understand and respect more;

- 68% say society expects women to take on responsibilities that it does not expect men to take on;

- 72% feel that men and boys still believe they are superior to women;

- 36% identify social and cultural factors, where girls are viewed as inferior to boys and not worth educating, as a barrier to girls accessing a quality education;

- 59% say it is important to have educational programs that teach girls diverse skills to be effective leaders and take risks;

- 43% want more lessons and textbooks to teach about the lives and accomplishments of women;

- 77% agree that if barriers to quality education for all girls are broken down, we can unlock their potential and develop women that will change the world;

- 67% see gaining equality and inclusivity in the workplace as a vital first step.

Brazil:

- 61% of Brazilian women are not very optimistic that gender equality can be achieved in the next five years, and 41% believe gender equality is impossible;

- 79% say girls need to be encouraged to speak up more to advocate for themselves, while 77% believe boys must be taught to listen, understand and respect more;

- 75% say society expects women to take on responsibilities that it does not expect men to take on;

- 87% feel that men and boys still believe they are superior to women;

- 45% identify social and cultural factors, where girls are viewed as inferior to boys and not worth educating, as a barrier to girls accessing a quality education;

- 71% say it is important to have educational programs that teach girls diverse skills to be effective leaders and take risks;

- 56% want more lessons and textbooks to teach about the lives and accomplishments of women;

- 87% agree that if barriers to quality education for all girls are broken down, we can unlock their potential and develop women that will change the world;

- 65% see gaining equality and inclusivity in the workplace as a vital first step.

China:

- 82% of Chinese women are not very optimistic that gender equality can be achieved in the next five years, and 36% believe gender equality is impossible;

- 50% say girls need to be encouraged to speak up more to advocate for themselves, while 43% believe boys must be taught to listen, understand and respect more;

- 44% say society expects women to take on responsibilities that it does not expect men to take on;

- 72% feel that men and boys still believe they are superior to women;

- 44% identify social and cultural factors, where girls are viewed as inferior to boys and not worth educating, as a barrier to girls accessing a quality education;

- 45% say it is important to have educational programs that teach girls diverse skills to be effective leaders and take risks;

- 34% want more lessons and textbooks to teach about the lives and accomplishments of women;

- 86% agree that if barriers to quality education for all girls are broken down, we can unlock their potential and develop women that will change the world;

- 56% see gaining equality and inclusivity in the workplace as a vital first step.

India:

- 41% of India women are not very optimistic that gender equality can be achieved in the next five years, and 39% believe gender equality is impossible;

- 79% say girls need to be encouraged to speak up more to advocate for themselves, while 78% believe boys must be taught to listen, understand and respect more;

- 81% say society expects women to take on responsibilities that it does not expect men to take on;

- 86% feel that men and boys still believe they are superior to women;

- 61% identify social and cultural factors, where girls are viewed as inferior to boys and not worth educating, as a barrier to girls accessing a quality education;

- 72% say it is important to have educational programs that teach girls diverse skills to be effective leaders and take risks;

- 63% want more lessons and textbooks to teach about the lives and accomplishments of women;

- 91% agree that if barriers to quality education for all girls are broken down, we can unlock their potential and develop women that will change the world;

- 54% see gaining equality and inclusivity in the workplace as a vital first step.

*The WU Scholar Program is administered and operated by the Institute of International Education, Inc. (IIE) a US private not-for-profit leader in the international exchange of people and ideas. The Western Union Foundation is a separate §501(c)(3) recognized United States non-profit corporation supported by the Western Union Company, its employees, Agents, and business partners working to support education and disaster relief efforts as pathways toward a better future.

About Western Union

The Western Union Company (NYSE: WU) is a leader in global payment services. Together with its Vigo, Orlandi Valuta, Pago Facil and Western Union Business Solutions branded payment services, Western Union provides consumers and businesses with fast, reliable and convenient ways to send and receive money around the world, to send payments and to purchase money orders. As of December 31, 2016, the Western Union, Vigo and Orlandi Valuta branded services were offered through a combined network of over 550,000 agent locations in 200 countries and territories and over 100,000 ATMs and kiosks, and included the capability to send money to billions of accounts. In 2016, The Western Union Company completed 268 million consumer-to-consumer transactions worldwide, moving $80 billion of principal between consumers, and 523 million business payments. For more information, visit www.westernunion.com.

WU-G

![]()

View source version on businesswire.com: http://www.businesswire.com/news/home/20170307005573/en/

![]()

MULTIMEDIA AVAILABLE :

http://www.businesswire.com/news/home/20170307005573/en/